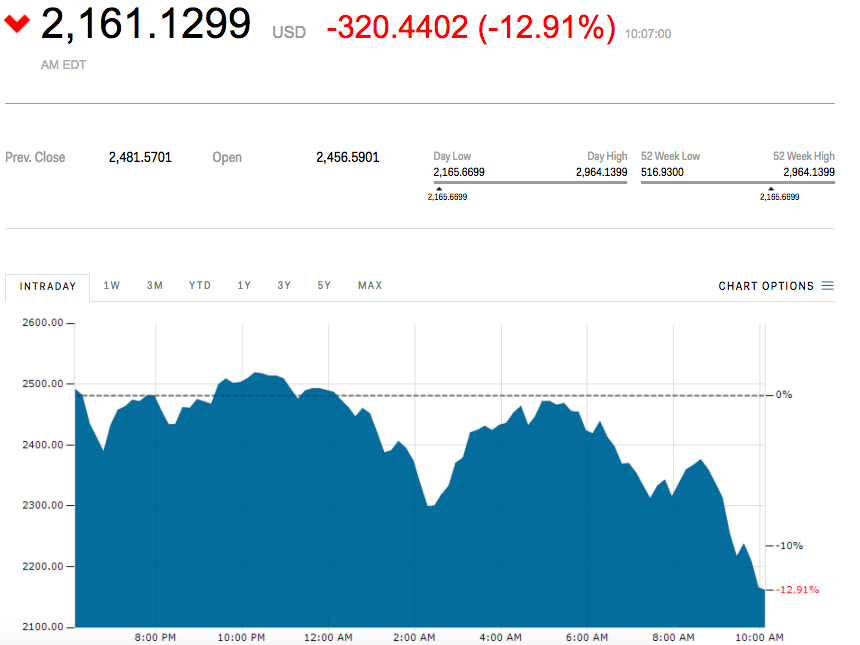

Bitcoin is plunging on Thursday. The cryptocurrency was trading down 12.9%, at $2,161 a coin, its lowest since the beginning of June. It’s now off almost 28% from its high of $2,999.97, reached on Monday.

The sell-off comes as markets around the globe are under pressure. On Wednesday, the Federal Reserve raised its key interest rate by 25 basis points and laid out its plan to unwind its massive balance sheet.

More importantly, the scaling debate has come back into focus, as the bitcoin-mining firm Bitmain outlined its “contingency plan” on Wednesday. Coindesk explained it best: “Most notably, the proposal would dedicate mining resources to hard forking the network to a rule set with a larger block size – an upgrade that would likely result in two bitcoin networks and two tradable bitcoin assets.”

But the writing has been on the wall. Bitcoin gained about 180% from the beginning of April through the middle of June. That run prompted tech billionaire Mark Cuban to call bitcoin a “bubble.” Goldman Sachs also sounded the alarm on bitcoin in a note to clients sent earlier this week, saying that “the balance of signals are looking broadly heavy” and the price could fall to as low as $1,915.

While the news surrounding the cryptocurrency has been mostly positive as of late, with China’s three largest bitcoin exchanges lifting their bans on client withdrawals and Japan’s government naming it a legal payment method, one big issue still needs to be resolved. The US Securities and Exchange Commission took public comment on its decision to reject the Winklevoss twins’ proposal for a bitcoin exchange-traded fund, but it is unclear when an updated ruling will be handed down.